cryptocurrency tax calculator reddit

Adjusted Cost Base. This is the first time the Indian government is discussing crypto taxation.

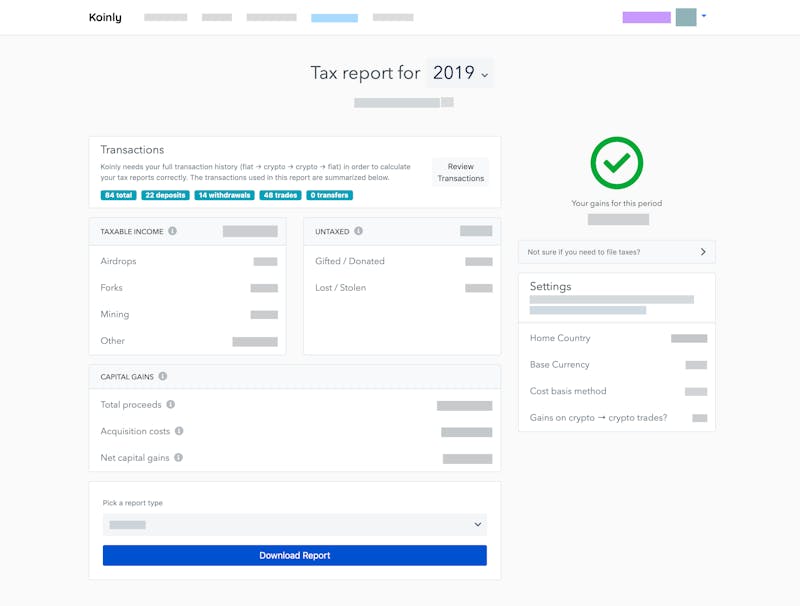

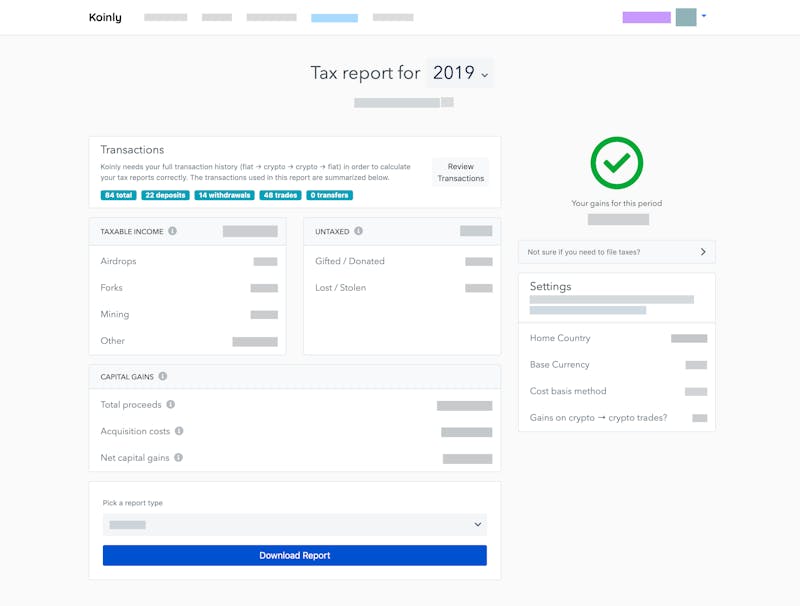

How To Calculate Crypto Taxes Koinly

It looks like this post is about taxes.

. Can export US and Canadian tax forms. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Initial purchase price of 5 x 25 units 125.

Connect 4500 coins form all exchanges and wallets. Super-fast crypto tax software. Supports USA UK Austria Germany and Switzerland.

Tax laws vary between countries so you may get more helpful replies if you specify the place you are asking about. Please note that Rule 4 does not allow for Tax Evasion. You simply import all your transaction history and export your report.

The tax will apply to all gains on digital virtual assets and no capital losses will be allowed. Taxpayers should also seek guidance on how to calculate the. 0325 5000 1625.

The brothers founded the. If you owned it for 365 days or less then you pay short-term. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income.

To calculate the cost basis when you sell any cryptocurrency simply multiply the total average cost with the number of coins sold or disposed of. Remaining units 75-50 25 so we need to include 25 units from the earlier sale to calculate our start balance. Cryptocurrency tax rates depend on your income tax filing status and the length of time you owned your crypto before selling it.

Overall best crypto tax software. Business expenses will also not be allowed. A major consideration from a state tax perspective is whether or not the purchase of virtual currency or cryptocurrency is a taxable sale for sales and use tax purposes.

So unrealized gains 600 - 200125 275. Australian Dollars triggers capital gains tax. Lets find out.

This is a site wide rule and a subreddit rule. 1 BTC is now worth A12000. Easy import from nearly any crypto exchange.

To calculate the cost basis according to the Adjusted Cost Base rule you need to keep track of the total purchase price and your total holdings of each asset at all times. Easily print tax reports at any time. Users can connect to over 100 exchanges and platforms to automatically import their data.

CryptoTaxCalculator was created to help crypto investors in the United States Canada New Zealand United Kingdom and Australia identify which taxes they are subject to when it comes to crypto investments. The majority of states have not yet issued guidance on the tax treatment of virtual currency or cryptocurrency. Popular Tax Calculators for Cryptocurrency Investors.

Calculate Report Your Cryptocurrency Taxes Free tax reports DeFi NFTs and support for 500 exchanges Import from Coinbase Binance Uniswap FTX. Janes estimated capital gains tax. Crypto taxpayers can use the Libra Tax calculator for free for up to 500 transactions while the paid subscription allows them to track.

Indian government just announced that crypto will be taxed at 30 of gains. The cryptocurrency tax calculator youll enjoy using. This is why cryptocurrency tax Shane explains is kind of a lagging market.

Selling cryptocurrency for fiat currency eg. Coinpanda is a cryptocurrency tax calculator built to simplify and automate the process of calculating your taxes and filing your tax reports. In my opinion at the tax year end you should NEVER have unrealized losses.

You can discuss tax scenarios with your accountant. The tax rate on this particular bracket is 325. Can be uploaded to TurboTax.

For example lets say Sam bought 1 bitcoin BTC for A5000 five years ago. Best crypto tax. Import your cryptocurrency data and calculate your capital gain taxes in Australia instantly.

Free report preview and trusted TurboTax partner. Whether you are a taxpayer looking to get an accurate crypto tax report a business looking to track your inventory or an accountant trying to work your way through a maze of transactions. Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king.

Koinly has got you covered. Do not endorse suggest advocate instruct others or ask for help with tax evasion. ATO Tax Reports in Under 10 mins.

Support for many exchanges. If he were to sell his BTC and cash out he would have to pay taxes on A7000 A12000 A5000 of capital gains. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant.

Were still picking up a lot of customers who were trading in 20172018.

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency

Crypto Com S Free Tax Calculator R Cryptocurrency

Cryptocurrency Tax Reports In Minutes Koinly

Cryptocurrency Trading For Beginners 2022 Complete Guide

Fine Missouri Fuel Tax Refund Form 4925 In 2022 Tax Refund Tax Refund

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Best Crypto Tax Software Top Solutions For 2022

:max_bytes(150000):strip_icc()/Crypto_Com_Coinbase_Head_to_Head_Coinbase-5a1d16401652466496531dd1cf6e348a.jpg)

Crypto Com Vs Coinbase Which Should You Choose

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

/Crypto_Com_Coinbase_Head_to_Head_Coinbase-5a1d16401652466496531dd1cf6e348a.jpg)

Crypto Com Vs Coinbase Which Should You Choose

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

Etf Vs Mutual Fund Which Is Better For You Finpins Mutuals Funds Mutual Investing Apps

How To Calculate Crypto Taxes Koinly

Cost Basis What Is It And How It Can Help You Calculate Your Crypto Taxes Coinbase

A Guide To Cryptocurrency And Nft Taxes

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Best Crypto Tax Software Top Solutions For 2022

Us Crypto Tax Software Options Your Preference Experience R Cryptocurrency